Financial planning and analysis are the integral part of business operations and help determine a company’s growth, profitability, sustainability, and overall financial performance. Organizations need accurate and measurable methods to determine many aspects of their finances so that they know how well they are doing in the market.

“The Federal Reserve Bank of Chicago’s recent Small Business Financial Health Analysis indicates business owners knowledgeable about business finance tend to have companies with greater revenues and profits, more employees and generally more success.”

Organizations need to be prepared for the future with business impact analysis and build successful strategies that are profitable, and investments that are sound. Availing financial analysis services can enable companies to have improved revenue and profitability by using financial data to drive and control business progress.

The Essential Components of Financial Analysis

There are many key components of financial analysis that help businesses see a complete view of their financial health. This helps them be better prepared to understand what strategies are impacting their business positively or negatively, so that they can make internal adjustments that will pivot them in new directions successfully. In fact, the same report by The Federal Reserve Banks of Chicago asserts that “understanding one’s finances and financial statements is a critical part of being able to assess what a business needs to survive and grow.”

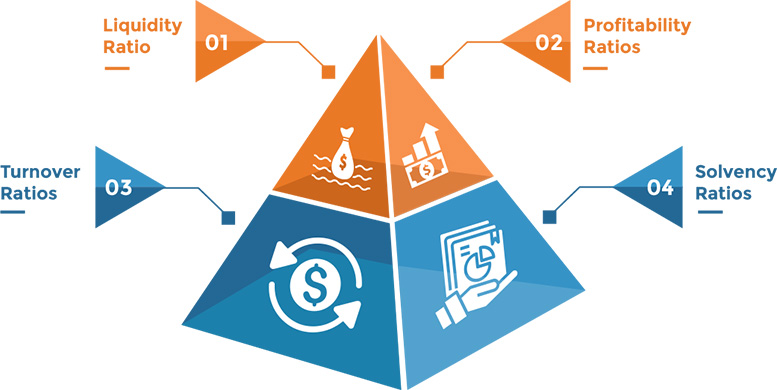

Here are some of the most essential components of financial analysis:

- Revenue Revenue is a measurement of a company’s overall net profits from sales, services, and from employee performance but typically doesn’t include one-time revenues. It’s typically a company’s core cash source, and lasting success can often be determined by the quality, timing, and amount of revenues.

For example, analyzing Revenue Growth would include revenue from this minus last period’s revenue, divided by last period’s revenue, and should never incorporate one-time revenues or results could be skewed.

- Income Statement Financial statement analysis detailing financial performance over a certain time period and helps to predict how a business will perform in the future by looking at gross profit margin, net profit margin, and operating profit margin.

- Balance Sheet Balance sheets help determine how you are best generating revenue and reports liabilities and assets and measures ratios like debt to capital and debt to equity.

- Cash Flow Statement Reports cash from financing, investing and operations and helps to accurately measure cash flow from how much cash is being generated over particular time periods.

- Profit Companies that fail to consistently product high quality profits are at risk when it comes to lasting survival. Consistent profits are a sign of long-term growth and is measured by your gross profit margin, operating expenses, and costs of goods.

For example, Operating Profit Margins determine an organization’s ability to generate a profit no matter the method of financing operations, such as through debt or equity. So, the higher the operating profit margin, the better positioned a company will be. Taxes and interest aren’t a part of operating expenses during analysis of this factor.

Net Profit Margins, on the other hand, are the remainders of what can be reinvested in a company and distributed to wonders via dividends. This is typically measured by a formula that subtracts operating expenses, cost of sold goods, and other types of expenses from revenues, before dividing by revenues.

- Capital and Solvency This helps to determine a company’s ability to meet its fixed expenses for long term growth by how much they spend in relation to the cost of their products and services.

The return investors are producing from a company is represented by the Return on Equity, which is an important factor that should be included in a business’s financial analysis.

Also, Debt to Equity is another critical element because this helps businesses understand how much leverage they’re relying on to operate efficiently, and this must not exceed a sensible amount for the company.

- Liquidity Measures how much money you can generate to cover cash expenses compared to what you purchased something for and how much you can sell it for without affecting the market price.

A financial analysis of this can address a company’s ability to produce sufficient cash flow to cover all of their various cash expenses. Generally, it’s understood that there’s no quantity of revenue growth, for example, that can counteract bad liquidity.

In this aspect of financial analysis, Current Ratio and Interest Coverage are evaluated. The former includes the business’s ability to pay any short-term cash commitments, while the latter calculates a business’s ability to cover interest expenses from any generated cash flows.

- Operational Efficiency The higher a company’s operational efficiency, the more profitable it is, and it measures the financial activity of transaction costs that have to do with a company’s investments. Basically, this calculates the company’s ability to utilize their own resources to their best advantage, and poor operational efficiency can often equate to less profits and growth.

To measure this, a financial analysis should incorporate Inventory Turnover, which is how well the company manages inventory. Higher numbers indicate that the company is doing this well, while lower numbers could mean that the company is over-producing for the amount of sales they’re generating, or they’re simply not selling enough.

Accounts Receivables Turnover should also be included in the analysis, and this would assess how well the company manages any credit that’s being extended to their clients or customers. In these cases, higher numbers are an indication of well-managed credit, while lower numbers are a good indication that the company needs to re-evaluate how they manage their collection process from their clients and customers.

Benefits of Financial Analysis

Financial analysis helps business owners and managers make financial decisions and choose the best route for investments based on historical data, trends, and other financial factors. Conducting a financial analysis uses balance sheets, income and financial statements, and cash flow statements. Here are the benefits of financial analysis:

- Measure Economic Trends Before you make impactful decisions and allocate resources to new investments, you can use past data to measure economic trends that will positively or negatively impact your business’s finances.

- Compare Competitor Performance Understand the strategies and investments that your competition is making in the market so that you can identify the best approaches for your own company and corresponding industry.

- Measure Future Profitability Measure and estimate how well your new investment strategies, and product and service offerings are going to perform in the market and how that will impact your company’s future growth opportunities.

- A Complex View of Financial Data Identify many different components of your finances with fundamental and technical analysis, such as earnings per share (EPS), and from trading and price movements.

- Discover New Investment Opportunities Find key opportunities, improve investor information, learn more about emerging and alternative markets, and improve stock market trading.

- Understand Financial Management Adjust financial management strategies, better allocate resources, improve financial planning, help financial efficiency, mitigate uncertainty, identify problems, and make more consistent decisions.

Outsource Financial Analysis to the Research and Analysis Experts

Research Optimus (ROP) has over a decade of experience providing financial business analysis for start-ups, small businesses, and enterprises in different industries all over the world. ROP’s researchers and analysts are tenured in using business analysis tools for financial research, business valuation, credit research, financial risk analysis, and more to help assist businesses make the best strategic financial decisions possible. Our team of analysts is ready to assist you; contact us for more information about our financial analysis services.

– Research Optimus

-Research Optimus